The Brihanmumbai Municipal Corporation (BMC) has officially shifted from reminders to strict enforcement. In a major move to recover unpaid revenue, the civic body has begun issuing “attachment notices” to some of Mumbai’s most significant property tax defaulters. For those on the list, the message is clear: pay the outstanding dues immediately or risk losing your assets to public auctions.

Why is the BMC taking this step?

Property tax is the lifeblood of Mumbai’s infrastructure. The money collected from property owners goes directly into maintaining roads, managing waste, providing water, and running public hospitals and schools. When large developers and commercial entities fail to pay their share, it creates a massive hole in the city’s budget.

According to recent reports, the BMC has identified several high-profile defaulters who owe hundreds of crores. These include well-known names like Raghuvanshi Mills Limited—which owes over ₹140 crore—along with several other major developers and corporations.

What happens next? (The Process)

The BMC isn’t just sending letters; they are following a specific legal path to ensure the money is recovered. Here is how the crackdown works:

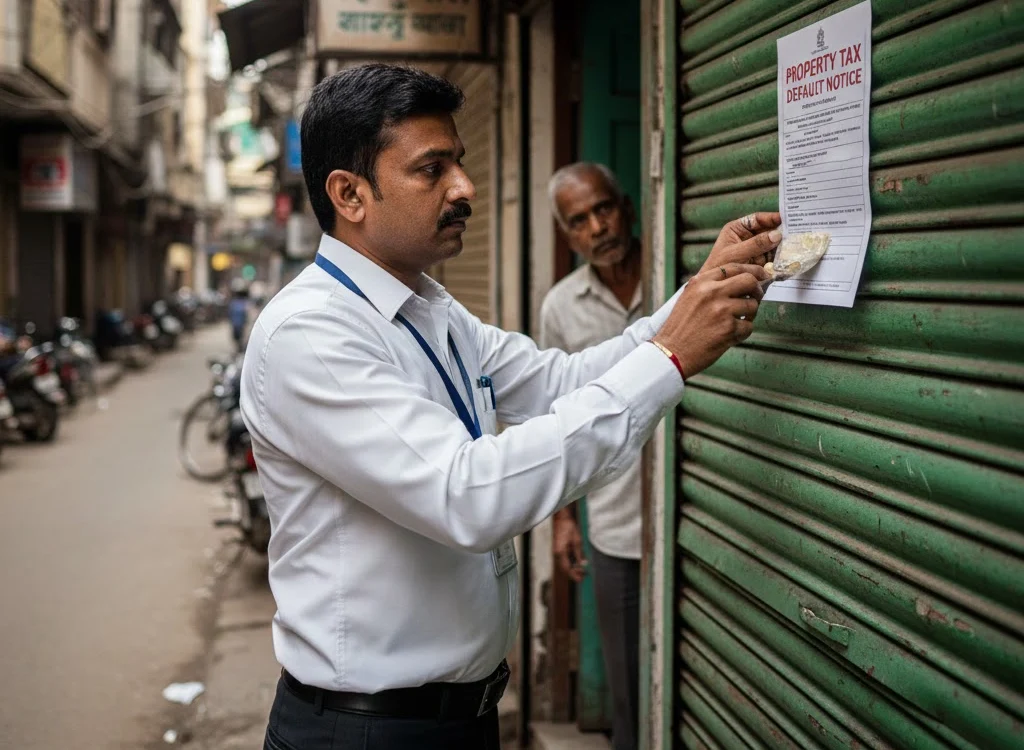

- The Attachment Notice: Under the Mumbai Municipal Corporation Act, the civic body issues a formal notice. This is the “final call” for the owner to settle the debt.

- Seizing Movable Assets: If the owner ignores the notice, the BMC has the authority to enter the premises and seize “movable” items. This could include office furniture, machinery, or other valuable equipment. These items are then auctioned to recover a portion of the tax.

- Property Auction: If the tax debt is still not cleared after seizing equipment, the BMC can take the ultimate step: seizing the land and the building themselves to sell them off to the highest bidder.

A fair warning to all

While the focus is currently on “big fish” like Raghuvanshi Mills and various construction firms, the civic body is sending a signal to all property owners. The authorities have noted that many of these defaulters have the financial capacity to pay but have chosen to delay or evade their responsibilities.

Additional Municipal Commissioner Ashwini Joshi has instructed officials to skip further delays and move straight to legal consequences for those who continue to ignore their bills.

How to avoid trouble

For the average property owner, the solution is simple: stay updated. The BMC follows a 90-day window for payments once a bill is issued. To make things easier, the city has improved its online portal, allowing owners to check their status and pay their taxes from the comfort of their homes.

By paying on time, citizens not only avoid the embarrassment of a public notice but also contribute to the growth and maintenance of the city they live in.

Also read – Navi Mumbai land dispute leaves development projects in limbo

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Readers should verify details with official BMC guidelines or consult a professional regarding tax liabilities.

Source – ET Realty

Write Your Comment