Home Loan Approval: What CIBIL Score Do You Need?

The credit score is a key factor in determining whether your home loan application will be approved. The CIBIL score is a major factor that determines whether your home loan application will be approved and at what terms.

What credit score is required to obtain a home mortgage?

This guide will explain a credit score, what it means in terms of home loans, the minimum credit score for home loan eligibility that lenders typically require, and what you should do if your score is less than perfect. This article can help you improve your financial situation, whether you’re a first-time home buyer or want to refinance.

Understanding Credit Scores

Credit scores are three-digit numbers that reflect your creditworthiness based on your borrowing and repayment history. This score in India is calculated most often by CIBIL, the Credit Information Bureau India Limited. It ranges between 300 and 900. Your chances of obtaining a loan at favorable terms are greater if you have a high credit score, especially when you need a good CIBIL score for home loan applications.

Importance of Credit Score in Home Loans

Your credit score is more than a number. It’s your financial passport. This score is used by lenders to determine:

- Your repayment capacity

- Credit habits and financial discipline

- Probability of default

A high CIBIL score increases your chances of getting a home loan, lowers interest rates and can often result in faster loan processing. Low scores can result in loan rejections or higher EMIs.

Minimum CIBIL Score for Home Loans in India

Different lenders may have different credit scores for home loan requirements, but most will prefer a good CIBIL score for home loan applications between 700 and 750 to ensure a smooth approval. Here’s the breakdown:

- Above 750:Excellent. You can expect to get competitive rates, flexible terms, and rapid approval.

- 650–699 Lenders can still offer you a loan, but at higher rates of interest or with additional documentation.

- If your score falls below 650, it will be difficult to get a loan. You may need alternative financing options, or you might want to improve your score.

Although some government schemes, such as PMAY (Pradhan Mantri Awas Yojana), may be flexible, most private lenders will still closely examine your credit report.

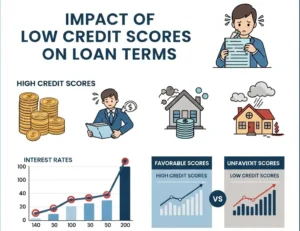

Impact of Low Credit Scores on Loan Terms

A low CIBIL does not mean that you will be denied a loan. However, it can affect the amount you pay and the terms of your loan. You might be faced with:

- Increased interest rates – Even a 1% rise in interest on your home loan can add thousands to the total amount you repay.

- Lenders might offer you lower loan amounts based on your risk.

- Delays, increased scrutiny, and paperwork.

- Eligibility requirements are stricter – need for collateral, income proof, or guarantors.

Options for Low Credit Score Applicants

Don’t give up hope if your credit score is low. You can still secure a mortgage by looking at alternative options.

Joint Applications

You can apply for a home loan jointly with your spouse, sibling or parent if they have a higher credit score. You can improve your approval odds by balancing out your credit profile.

Approaching NBFCs

Non-banking financial Companies are more flexible when it comes to credit scores than traditional banks. They are still a good option, even if the interest rates might be slightly higher.

Securing a Co-applicant

Co-applicants with strong financial profiles can boost your credibility and reassure the lender.

Focusing on Small Finance Banks

Small finance banks and regional lending institutions may cater to underserved clients and have lower credit scores.

Strategies to Improve Your CIBIL Score

You can save a lot of money if you improve your credit score prior to applying. How to improve your credit score:

Timely Repayments

Your EMIs and credit card bills must be paid on time. Your credit score is negatively affected by late or missed payments.

Maintaining a Healthy Credit Mix

Credit profiles are improved when you have a good mix of secured debt (car, home) and unsecured debt (credit cards, personal loans).

Avoiding Multiple Loan Applications

Each loan inquiry will result in a hard credit inquiry. A high number of inquiries can indicate financial desperation, which will lower your credit score. Selectively and strategically, choose your options.

Exploring Loans with Extended Tenures

If your credit score is borderline, a longer-term loan can help you reduce your EMIs and improve your application. Even if you have a low credit score, lenders will consider a lower EMI as indicating repayment capacity. To know more about EMI hacks and strategies that can further optimize your loan terms and monthly payments, consider exploring various repayment techniques.

Checking and Rectifying Credit Report Discrepancies

Low credit scores can be due to a variety of factors. Your score can be affected by errors such as outdated information, incorrectly reported defaults or closed accounts that are still marked open.

Here’s how to fix it:

- CIBIL, along with other credit bureaus, offers free credit reports

- Check for errors or discrepancies

- Online dispute and supporting documents

- Continue to follow up until the corrections appear on your report

It is wise to monitor your credit report regularly. This will help you avoid unpleasant surprises.

Conclusion: Managing Credit for Successful Home Loan Approval

Your CIBIL is more than a number. It’s a reflection of your financial discipline, and it can help you get a better home loan. Although most banks prefer a score of 700-750 or higher, a lower score doesn’t mean you can’t get a home loan. You can still achieve your dream of homeownership by using smart strategies such as improving your credit score, applying together, or looking into NBFCs.

Next time someone asks you, “What credit score is sufficient for a home mortgage in India ?-you will know that it’s about smartly managing the number for the best outcome.

Write Your Comment