Mumbai has always been India’s land of dreams for property. But in recent years, the Mumbai real estate market has seen a boosting upward wave. Buyers, builders and experts are wondering: what is driving the sudden surge in Mumbai property prices?

Here, we deconstruct the numbers, chart the drivers and examine if this boom in Mumbai property rates is sustainable or unstable.

Mumbai Real Estate by the Numbers: The Boom

In order to comprehend what is fueling the boom, we need to ground ourselves in the numbers first. Some top-line trends:

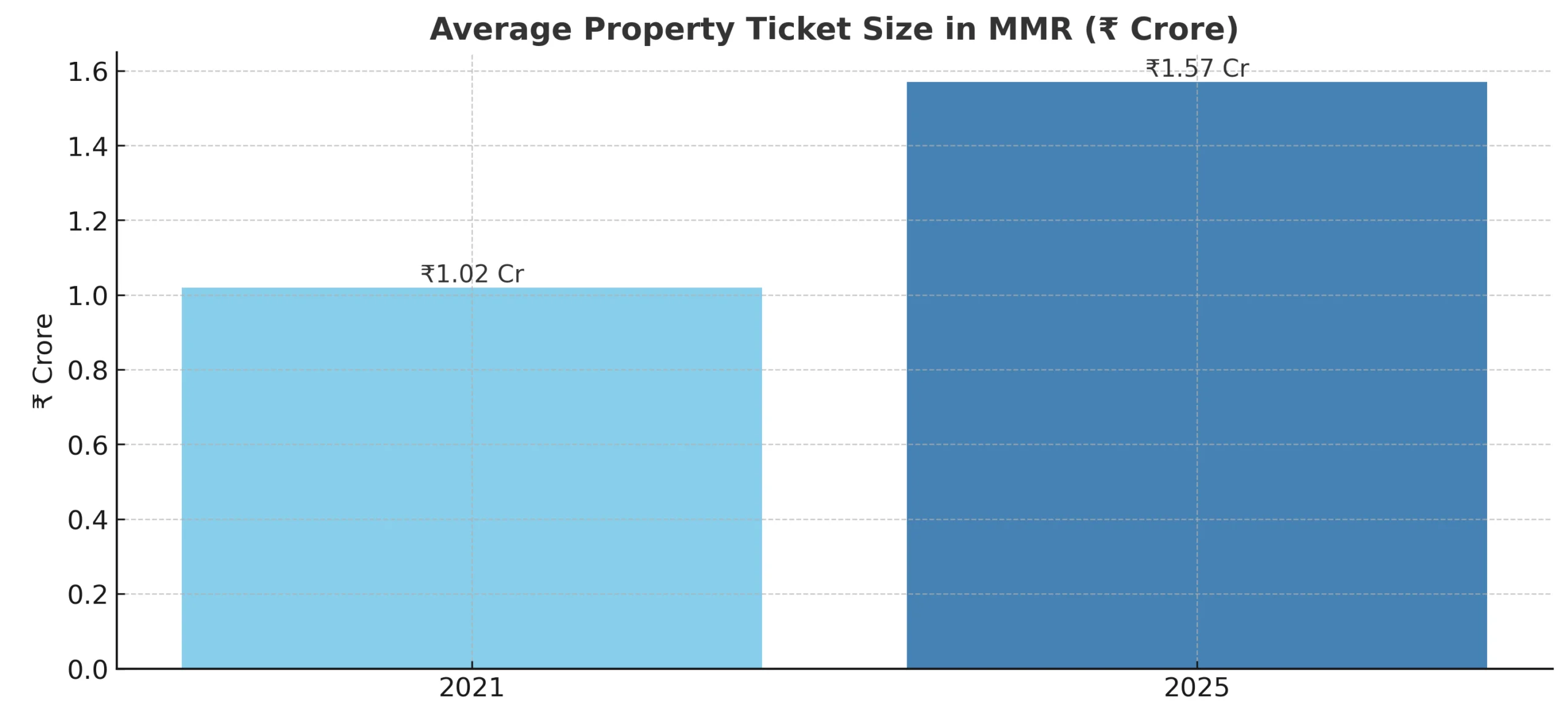

Anarock’s analysis shows that the average ticket size of Mumbai properties in the Mumbai Metropolitan Region (MMR) has increased by 54 percent over four years to ₹1.57 crore in Jan–Apr 2025 compared to ₹1.02 crore in the corresponding period in 2021.

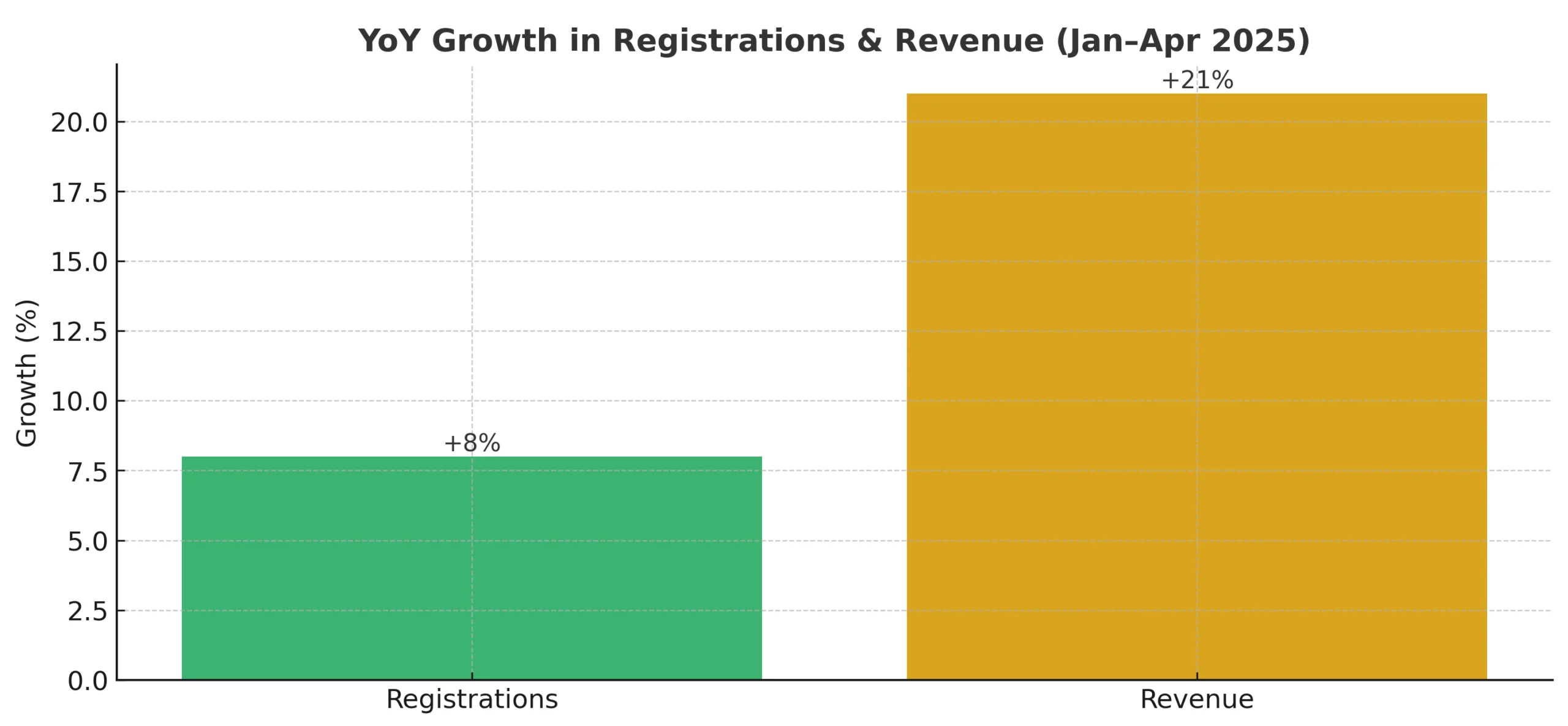

During the first four months of 2025, Mumbai recorded 52,896 property registrations — an 8 percent increase year-on-year — and overall registration revenue amounted to ~₹4,633 crore, a ~21 per cent increase compared to the previous year.

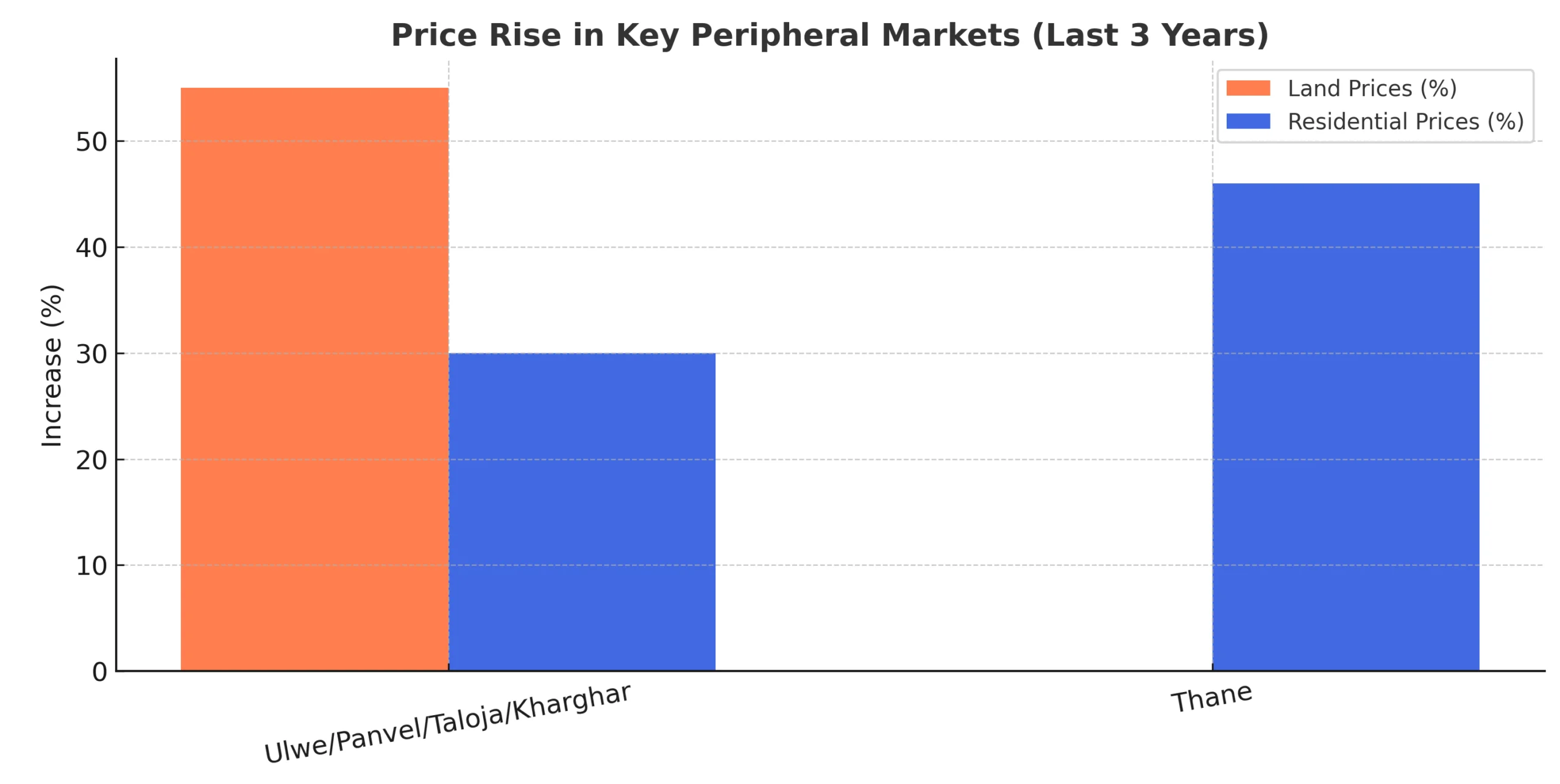

In peripheral markets such as Ulwe, Panvel, Taloja and Kharghar (Navi Mumbai / MMR corridor), land prices have risen by 50–60% in the last 3 years. Residential prices have also gone up 20–40% in the same timeframe.

In the recent Navratri celebrations (Sept 22–Oct 1, 2025), within BMC jurisdiction, 6,238 registrations were registered — roughly 20% higher than in the corresponding period of 2024 — indicative of reviving buyer confidence in Mumbai real estate.

For one micro-market, Thane (which is included in the extended Mumbai real estate universe), analysts see a 46% rise in property prices in three years.

These statistics tell a certain tale. Mumbai property prices aren’t just creeping higher, they’re rising in many areas, but unadulterated growth only tells half the tale. What is driving these upward pressures? Let’s drill deeper.

Major drivers of the Mumbai property boom

1. Supply Shortages + Land Shortage

The geography of Mumbai is bounded by sea and hills and more so by zonal, coastal, and regulatory limits. The availability of land to use is limited, which raises competition for pieces of land. Opportunities for new development are few in inner and prime areas, which makes available stock more precious. This structural restraint imparts an upward tilt to Mumbai property rates over the long term.

2. Infrastructure & Connectivity Upgrades

Connectivity projects are recasting valuations along corridors:

The new Metro extensions (e.g. Line 3 between BKC–Worli and others) have already led to value appreciations. Observations indicate rents and prices around the BKC–Worli corridor increased by ~1–2% shortly after operations commenced.

Transit-oriented development forces “remote” areas into demand. Better-connected suburbs (to roads, metros, and highways) appreciate more quickly.

Major projects like the Navi Mumbai Airport and supporting infrastructure have triggered speculative land buying and sharp jumps in Mumbai real estate pricing in fringe zones like Ulwe, Panvel, etc.

3. Strong Buyer Sentiment / Investor Interest

Even as global headwinds persist, Mumbai’s property market continues to attract investors. In 2025, registration numbers and revenues broke records despite macro uncertainties.

The festive season phenomenon is equally robust: the Navratri bounce (20% increase in registrations) highlights the extent to which sentiment-driven and calendar-related purchasing continues to be significant in Mumbai real estate.

Several high-net-worth individuals also consider Mumbai property to be a “safe store of value,” particularly in upscale areas

4. Premiumization & Upward Skewing of Sales Mix

The rise of the average ticket price by 54% in 4 years indicates that higher-ticket transactions are being registered as a percentage of lower-ticket transactions. Translated, an increasing proportion of sales is taking place in premium/luxury segments, which disproportionately drive average Mumbai property rate metrics.

5. Regulatory Adjustments / Ready-Reckoner Changes

Periodic ready-reckoner (stamp duty base) rate changes encourage rushed registrations before increases or revisions. These actions can cause momentary spikes in the number of property registrations and increase the “observed” property rates in Mumbai in the registered data.

6. Credit / Interest Environment & Affordability

Though interest rates have been fairly stable, modest relaxation or better credit access assists marginal purchasers in stretching their budgets. Furthermore, most of these buyers are trading up or upgrading within Mumbai real estate instead of first-time buyers moving in, allowing them to take up increased prices.

However, increasing rates will put pressure on affordability, particularly for the mid-segment.

7. Spillover from Mumbai to Satellite / Peripheral Areas

As inner city Mumbai properties, demand is spilling out. Suburbs and peripheral municipalities are the next frontier. That’s evident in the sharp land and residential price increases in Navi Mumbai / Ulwe / Panvel.

8. Micro-Market Contrasts & Local Anomalies

It should be noted that Mumbai real estate is not homogeneous. There are slower-growing micro-markets or even slight corrections:

In South Mumbai and Mumbai Central, some segments have witnessed negative yearly movements. For example, flat rates in central and south zones are said to have dipped ~7.4% over the last year and ~22% over three years, in some areas.

Even in these zones, however, ultra-prime properties (sea-facing, limited stock) still command sky-high per ft² prices.

Local irregularities develop because of infrastructure delay, redevelopment holdups, or regulatory hurdles (e.g., FSI/redevelopment regulations). Thus, not all pockets contribute equally to the Mumbai property rate surge.

9. Risks & Sustainability Checks

To be sustainable, the boom in property rates in Mumbai has some caveats and risks:

Affordability Ceiling

If rates outstrip income growth or credit ability, end-user demand may erode. Double-digit growth can’t go on forever.

Interest Rate Risk

A Sudden increase in interest rates (e.g., due to macro inflation) can arrest buying momentum.

Overreliance on Speculation

Where most of the growth is based on speculative purchase and not end-use demand, the market may be susceptible to correction.

Regulatory / Tax Shocks

Unexpected changes in stamp duty, capital gains or construction norms can surprise the market.

Supply Catch-up in Peripheral Areas

Developers can introduce more supply over time to suburbs, which may temper runaway price growth there.

Localized Cooling

Not all areas will keep up; poorer micro-markets may plateau or correct.

What It Means for Buyers & Investors

For buyers: The spurt translates into urgency, securing before prices rise again. But buyers must beware of stretched wallets and paying too much in speculative areas.

For investors: Prioritize corridors with a connection to infrastructure improvements (metro, highways, transportation hubs). Peripheral areas with observable growth directions can present higher upside potential than tapped inner city markets.

Micro-market due diligence is critical: Don’t believe in averages at the city level. Consider connectivity, regulatory transparency and developer history.

Hold horizon issues: With cycles in place, real estate is a medium-to-long horizon wager. Flipping in hot environments is riskier over the short term.

The boom in Mumbai property and Mumbai real estate is being sustained by a powerful mix of supply shortages, infrastructure improvement, delayed demand, investor confidence, and premiumization factors. Mumbai property rates are rising not only in the city center but also along satellite corridors, redefining how individuals perceive investment and ownership in this city.

But all zones or segments are not on the same wave — micro-market variations, affordability thresholds, and regulatory forces will temper where the wave peaks and where it stabilizes or ebbs. For consumers and investors alike, the imperative is identifying Mumbai property rate trends at a micro-level, basing decisions on infrastructure and regulatory thrust and strategizing with a pragmatic horizon.

Conclusion

Mumbai’s property boom is driven by limited land, better infrastructure, and rising demand, especially in premium and well-connected areas. However, growth varies by location, and risks like affordability and speculation remain. Smart, long-term decisions based on micro-market trends are key for both buyers and investors.

Write Your Comment